How small businesses keep on top of their invoicing has changed radically over the past few years. More and more businesses are switching to cloud accounting software to make the most of the benefits of online accounting and to help streamline their core processes.

As a small business owner, you might be a born entrepreneur, but you’re less likely to be a born accountant. So it’s possible that you’ll find bookkeeping a tedious distraction, especially when your focus lies with building your brand and growing your business.

Accounting apps like QuickBooks, Xero, and Sage can help make your entire operation run more smoothly. And that gives you more time to do what you love best—growing your business!

What is cloud accounting software?

Cloud accounting is used synonymously with online accounting and web-based accounting.

Top 3 cloud accounting apps for small businesses

Your business needs a user-friendly accounting solution to manage finances effectively.

That’s why cloud-based accounting apps have become so popular for bookkeeping, real-time data access, automation, and third-party integrations.

Here are top 3 cloud accounting apps that small businesses use around the world.

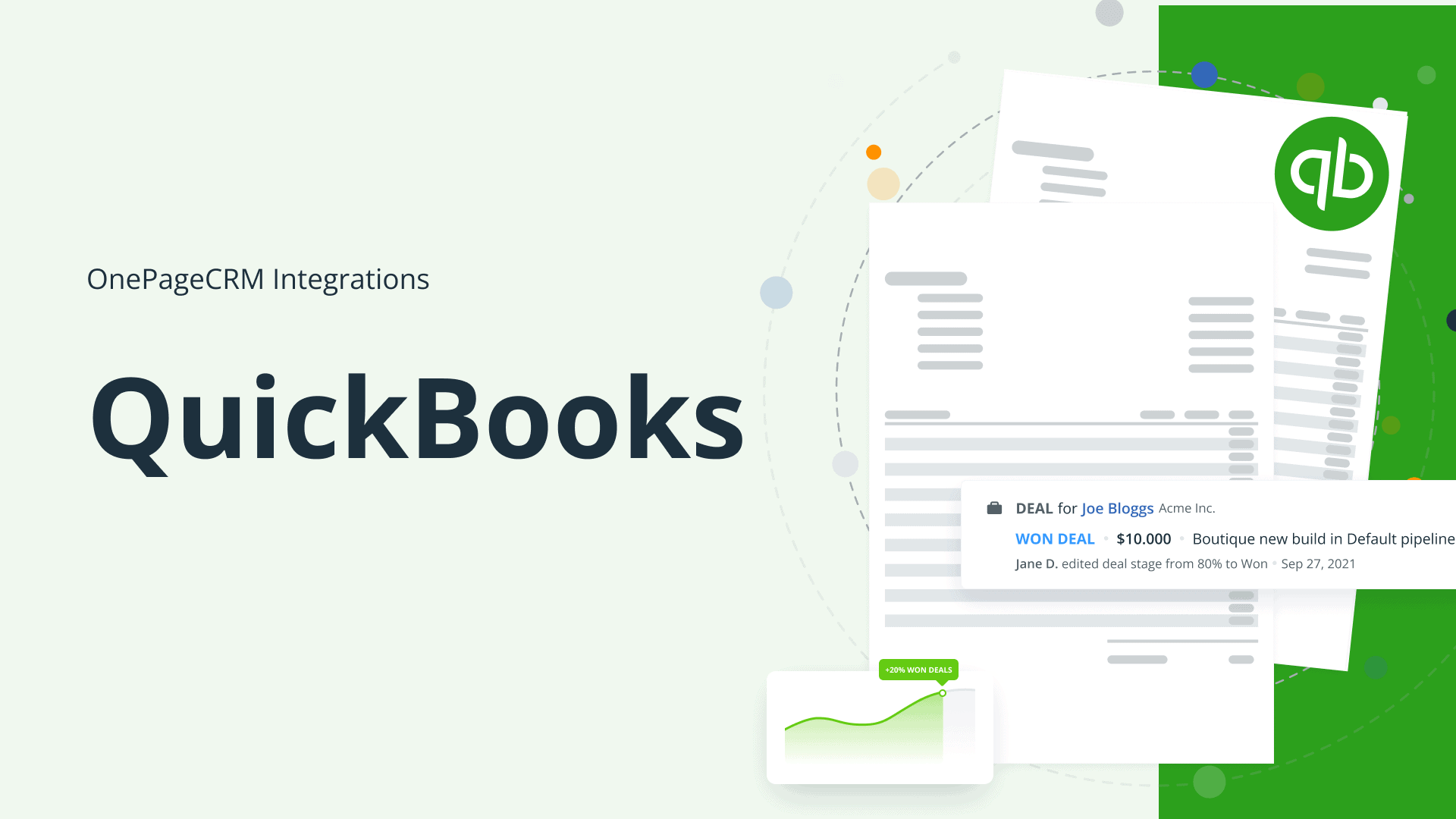

1. QuickBooks

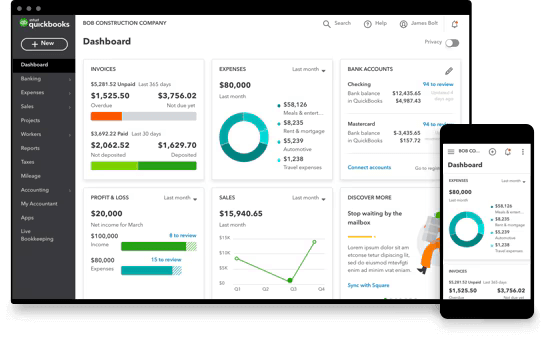

QuickBooks is an accounting software for small to medium-sized businesses. Its intuitive interface makes it easy to manage financial tasks in your business: invoicing, expense tracking, and payroll processing.

QuickBooks also offers reporting and analytics tools, allowing businesses to gain insights into their financial health.

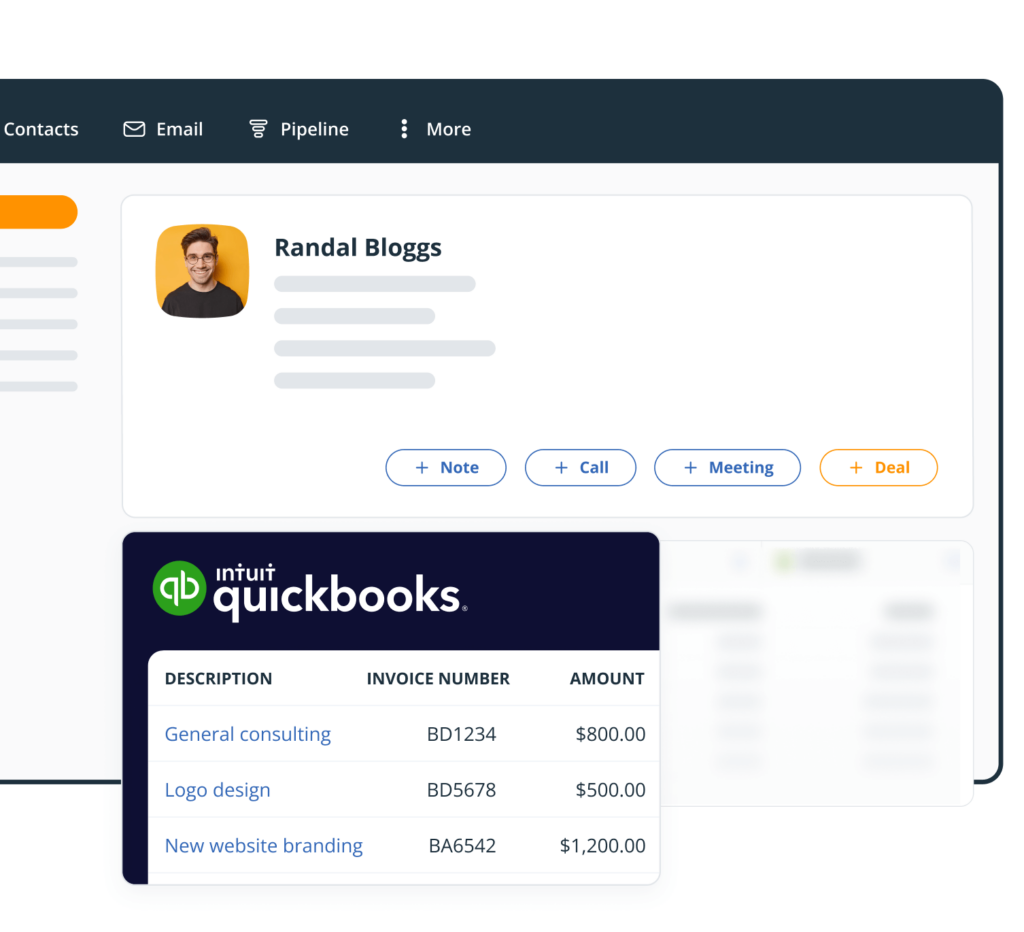

QuickBooks integrates with many third-party apps, including CRM systems. For example, in OnePageCRM, users can add a QuickBooks widget to every CRM contact. The widget will show all QuickBooks invoices and quotes associated with these contacts so that you don’t need to switch between QuickBooks and your CRM all the time.

2. Xero

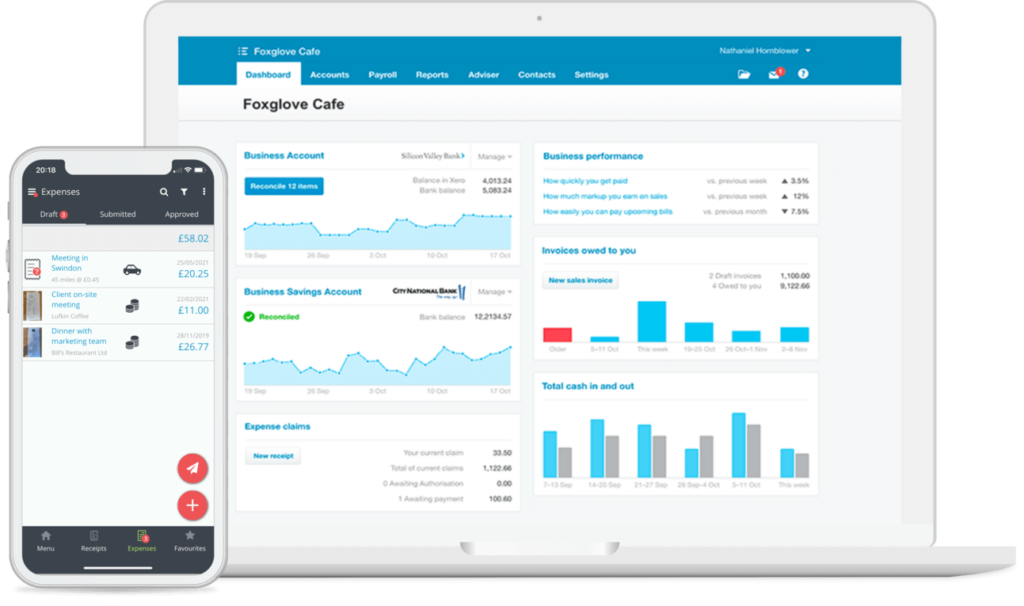

Xero is another cloud-based accounting app designed for SMBs. It also has a fairly user-friendly interface and a variety of financial and accounting features, such as invoicing, bank reconciliation, and expense management.

Xero offers real-time financial reporting and customizable dashboards, giving businesses clear visibility into their financial status.

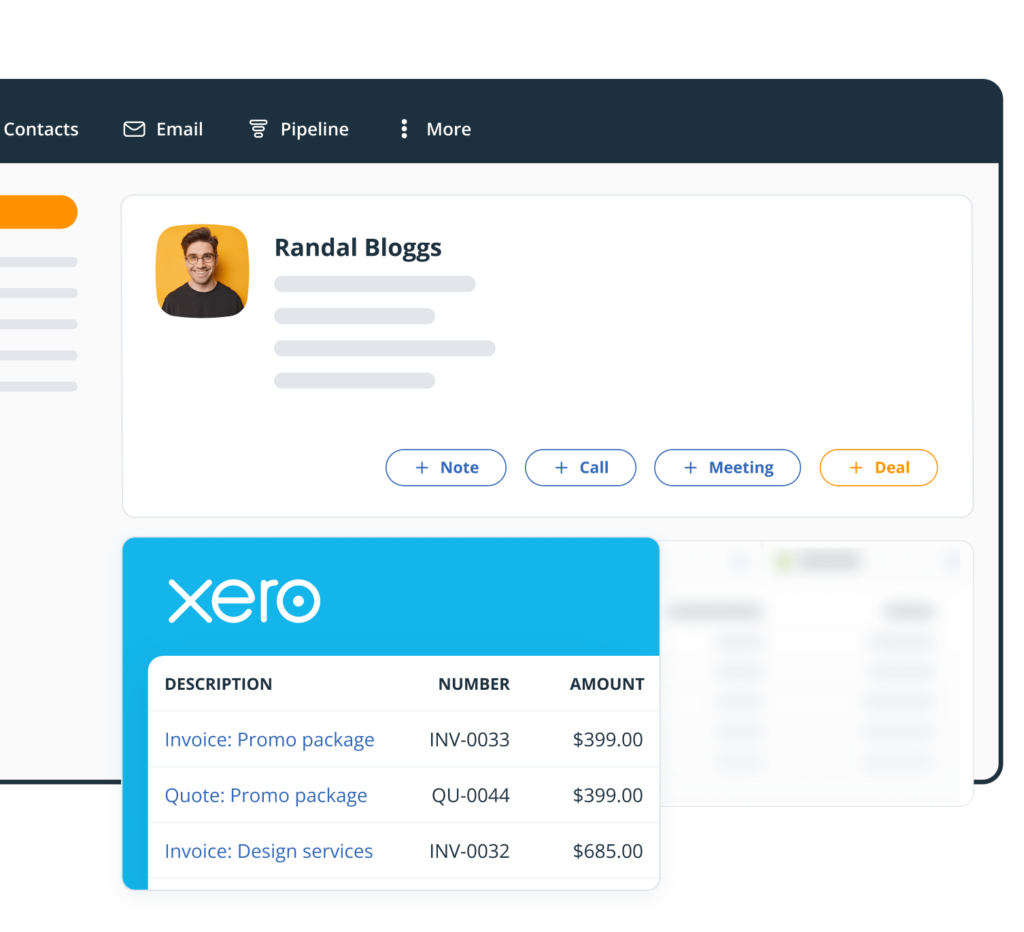

With over 1,000 third-party partners, Xero also has a robust integration with OnePageCRM. With its simple Widget, your sales team can always see all Xero invoices and quotes associated with their CRM contacts. This gives them a 360-degree view of your invoicing history with every client.

With the Xero widget, your team no longer needs access to your Xero account or to send back-and-forth messages to your accounting team.

This Xero-OnePageCRM ecosystem allows businesses to align their accounting and sales teams for better results.

3. Sage Accounting

Sage Accounting is another popular accounting cloud solution among small businesses. It offers similar functionality to QuickBooks and Xero, the final choice will depend on the business needs, long-term plans (scalability), and budget.

Sage Accounting has an intuitive interface to manage all key accounting processes without any difficulty. It also has sufficient reporting tools to help businesses gain real-time insights into their financial performance.

Cheaper accounting software?

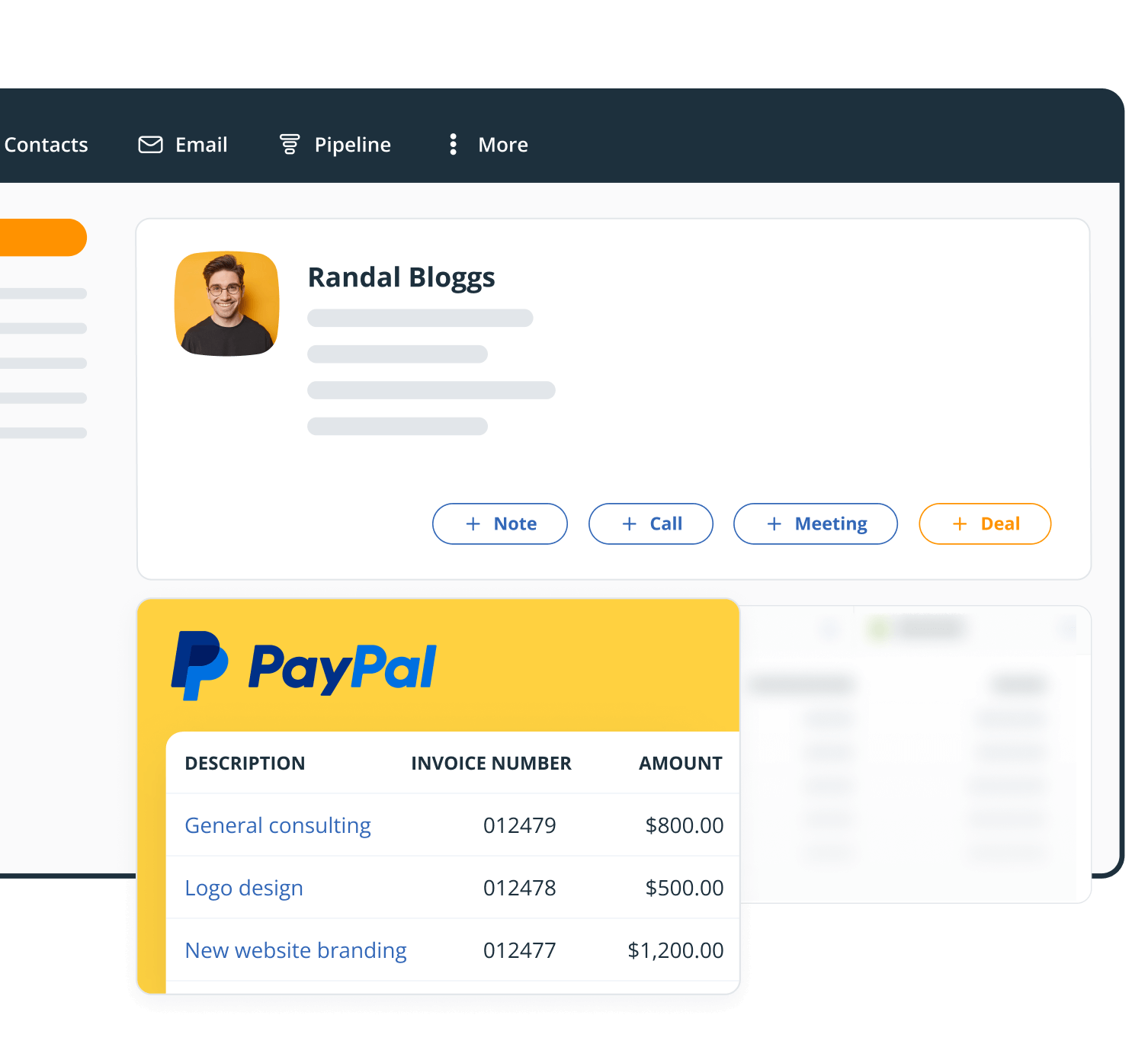

Similar to QuickBooks and Xero, PayPal also has a CRM widget that you can easily add to Contact Pages to have all the important information in one place.

Instead of fixed monthly or annual pricing, PayPal offers merchant fees on every sale made.

Thanks to the CRM integration, all of these invoices will be safely logged and orderly recorded in your CRM account.

Key features of cloud accounting software

Cloud accounting software, like many cloud apps these days, has a wide range of features. But for a small business, it’s important to keep in mind only the most important ones and not get side-tracked by other functionality.

So here are the top features of a cloud accounting app for a small business:

1. Invoicing and billing

Invoicing and billing are the most basic functionality of cloud accounting software. They are also the primary reason a business starts looking for an accounting app.

Make sure that your cloud accounting software helps you create and send invoices quickly and set up recurring payments for regular customers.

Ideally, you want to choose an app that is easy to use and doesn’t have a steep learning curve.

2. Tracking and reporting

While small businesses don’t need complicated reports, there should be some simple dashboard to help you easily track expenses, monitor your spending patterns, and generate tax-compliant financial documentation.

When assessing this functionality of cloud accounting software, it’s important to pay attention to what exactly you need to report on. Avoid the temptation of choosing an app with interactive dashboards if this is not what your business needs right now.

Reporting can get overwhelming, so before testing any accounting apps, it’s better to create a list of tasks for which you absolutely need this software.

3. Suitable integrations

Cloud accounting software is one of the most important tools in your business, but it is still only one of them. Before committing to one provider, have a look at their integrations: do they integrate with other apps in your ecosystem?

A good cloud accounting app should also integrate with a CRM system. While accounting software also has customer-related data, a CRM is usually the central app that pulls in data from all other apps (not only accounting ones) and consolidates this data in one place. So make sure that your cloud accounting software works well with your CRM.

5 benefits of using cloud accounting software in a small business

Here are our top 5 reasons why running a business is more efficient with cloud accounting software:

1. Easy access to financial data anywhere and anytime

Using a cloud-based invoicing app gives you easy access to your figures anytime, anywhere. It’s hosted remotely which means you don’t need to worry about any time-consuming downloads and updates.

To keep up with business on the go, you can even access your invoices using a mobile app. This gives you added flexibility and peace of mind, meaning you don’t need to be sitting in your office to check your cash flow or access your accounts.

2. Up-to-date view of your business

When your data lives in the cloud you’ve always got a completely up-to-date view of your current financial situation. And that allows you to make better-informed decisions about the financial future of your business.

Using traditional accounting methods, you’d have to scroll through pages and pages of out-of-date management reports. Now you’re looking at your company’s finances in real-time—and that’s a pretty amazing benefit when you’re a fast-growing company.

3. Better relationship with your accountant

As a business owner, you’ll still need to regularly collaborate with your accountant to make sure your financials are up to date, particularly when it comes to filing your end-of-year tax returns to the revenue.

As a result, you may spend a lot of time with your accountant—which can be both costly and time-consuming. But with a proper cloud accounting app, you and your business advisers will always be looking at the same online ledger.

That means you’ll get a much deeper and more valuable client/accountant experience by talking about your finances in real-time conversations. Your accountant goes from being an expensive compliance overhead to being an integral part of your management team.

4. Paperless and decluttered office

Keeping your paperwork in order can be a challenge. Expenses, receipts, and invoices all mount up—and working your way through them takes time.

With a cloud accounting app, you can import your paperwork straight into your accounting software, moving your data straight into the digital realm and allowing you to see your numbers at a glance. It helps minimize the risk of manual error and results in a faster and far more efficient method for keeping on top of your finances.

5. One ecosystem for your small business

Finding one system that delivers all your business needs can be difficult. That’s why its vital to integrate with other online apps which help form part of an entire ecosystem.

Using a cloud accounting app and a CRM side by side can join the dots—from generating and nurturing leads to ultimately creating revenue. Depending on your needs, you can create a workflow that works for your business and improves the efficiency of regular tasks such as invoicing, reporting, payroll, etc. Cloud-based applications play a huge part in making that possible.

Make the move to cloud accounting software easy

So, it’s clear that a revolution in accounting software has taken place: desktop-based software is dead and the cloud is where it’s all happening and fast!

If you’re an ambitious, tech-savvy, 21st-century business, cloud accounting is the unrivaled option for keeping on top of your finances.

Cloud Based is the best accounting tool for small business tool for growth and to gain success. Thanks for this!

Thanks for your comment Gwyn 😀

I am happy that there are a lot of tools now that helps business owners like me in accounting. I am also using Zero . I can say that I find the best accounting software. Thanks for sharing this article. I really enjoy reading this.

Hi, thanks for your comment. Great to hear Zero and other software tools are aiding you with your business. Evelyn

“Thanks Steve for sharing the informative article. Many businesses prefer the flexibility and simplicity of cloud computing to conventional local hosting and on-premise software when it comes to data storage, processing, and collaboration.

Your reliance on paper can be significantly reduced with an online accounting solution. Direct emailing of invoices to customers reduces printing and postal expenses and expedites the payment process. Incoming bills and receipts can be scanned and preserved alongside the related transactions in your accounting software.”

We’re glad you like this blog post, Ian!